Matthias Kröner

Blogger. Creator. Banking CEO.

Rethinking Financial Services

Matthias Kröner

Matthias “mk” Kröner is a highly respected thought leader within the global financial services community when it comes to planning, building and operating disruptive and customer-centric banking business models. The tech enthusiast is one of few people worldwide who has co-founded two digital banks, serving them as entrepreneur and CEO.

Matthias “mk” Kroener was until March 31, 2019 CEO, co-founder and shareholder of Fidor Group, a Munich-headquartered digital and mobile bank and financial services technology provider. Under his leadership, Fidor has grown massively. Today, Fidor acts globally (running offices in Dubai, Munich, New York and Singapore), operates in BtoC and BtoB and has received a string of awards for its innervational capability. Before Fidor, mk co-created Europe’s first digital bank and online broker, DAB bank, and served as its CEO.

As a thought leader, mk is known as an inspirational keynote speaker. He is also a successful incubator for several highly innovative start-up companies.

The link between all of these roles is that mk is driven by a strong sense of purpose. His mission is to democratize consumers’ access to banking and self-determined finance management, using digital financial services to create sustainable values.

Breaking Bank Europe

Mk is a proud co-host of global Breaking Banks Europe Podcast:

“Chris Colbert and Guido Betz discuss how innovation within financial services might be enabled by technology, but first, it needs the right cultural set up, environment and understanding. Meet the hosts of Breaking Banks Europe: Matteo Rizzi, Nina Mohanty and Matthias Kroener as they discuss what sets the fintech industry in Europe and the UK apart from the rest of the world.

Featured Videos

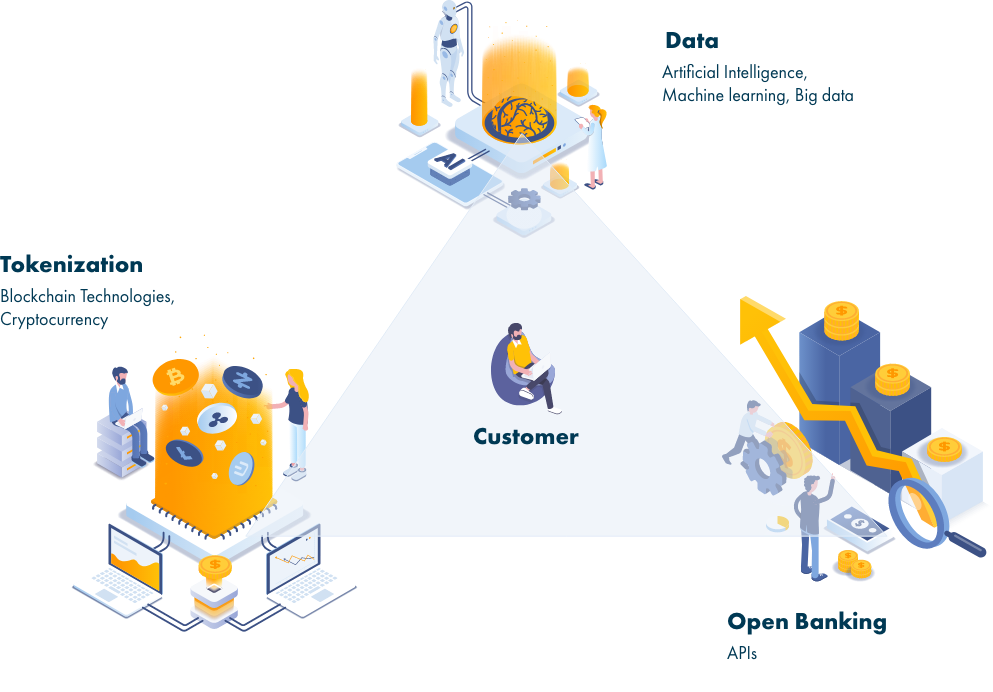

Focus of future activities lies within the triangle of Data, Tokenization and Open Banking.

It is mk’s strong belief, that those 3 components will drastically change the global landscape financial services.

Since its foundation in 2016, mk is a frequent guest and speaker at the Singapore Fintech Festival.

In 2019, he was for example participating in the Panel “The Rise of Digital Banks”

Current Projects

Re:ceeve

A truly digital debt-servicing platform (“DSP”) driving the future of financial services.

One obvious way improving a bank´s EBT without creating the need of additional equity is decreasing the rate of NPLs. But, how to achieve that?Today´s world of Data and AI allow new approaches which do not only improve a bank´s EBT but also the customer experience. Re:ceeve is offering such a solution which is why mk supports that company as a business angel and senior advisor.

Lead1ng AG

Helping Leaders & Entrepreneurs to achieve their ambitious goals

More than anything else, Fintech is a Culture-Game, not a Tech-Game, which is why mk is sharing his leadership experience as a member of the supervisory board.

On top, HR-Management has to understand that the digital and mobile lifestyle also is changing the behaviour of a companies team. Tools of HR management must reflect that development.

Future Projects

Focus of future activies lies within the triangle of Data, Tokenization and Open Banking.

It is mk´s strong belief, that those 3 components will drastically change the global landscape financial services.

Matthias on Social media

Get inspired

Matthias Kroener is known as an inspiring thought leader and keynote speaker for banking, fintech and the disruption of the global financial services industry.

He loves to share and discuss his thoughts and believes in the next big thing – in personal exchange and social media. Below you will find some brain food, for example videos and media coverage.

Unable to load Tweets

Follow